Vision Furniture is a special event rental company and chiavari chair manufacturer based in Philadelphia. It operates a factory in Qingdao, China, that crafts Vision’s BIFMA-compliant wooden chiavari chairs. Vision sees firsthand how the rise in tariffs* directly affects businesses importing goods, and how these costs trickle down to customers in the event industry.

*Wait, what tariffs? The U.S. government has put 25 percent tariffs on three separate lists of goods being imported from China. A large percentage of furniture and other decor used in the special event industry is produced in China and included on these lists. Even though there has been a lot of news about Chinese tariffs, many people do not seem to understand how they will be affected because most people are not directly feeling their effects … yet.

We talk to customers all the time who do not know that event products are even affected by the tariffs. As an importer, we are on the front line, the first in the supply chain, so we see these costs first. The 25 percent tariffs went into effect on June 1, 2019 and (wow!) they are significant.

First Invoices with 25 percent Chinese Tariffs Have Arrived--Event Industry Suffering

At Vision Furniture, we are a robust event furniture company, but even healthy businesses feel the pinch now that the 25 percent tariffs on Chinese goods have hit the event industry. Higher bills are starting to roll in. Much higher.

The 25 percent tariff is even more shocking when you actually see it in dollars and cents. We just received our first freight bill with the 25 percent tariff tacked on.

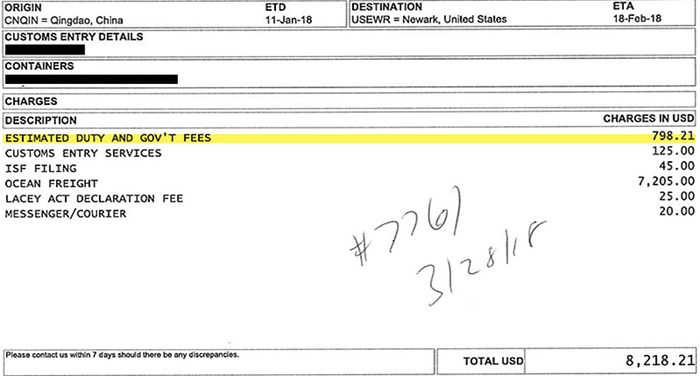

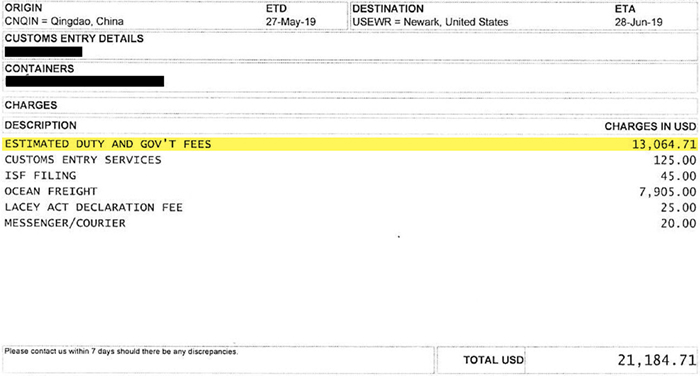

Here you can see two comparable direct container invoices--one from 2018 before the new tariffs took effect (Figure 1) and one bill for similar items from June 2019 with the tariffs (Figure 2):

Figure 1:

Figure 2:

As you can see, duties and government fees have skyrocketed. We needed approximately $8,500 to cover the import costs for two containers back in 2018, and now we need over $21,000 for the same items. With container after container scheduled to come in, we will need a lot more cash on hand to pay for the same goods.

Cash-Strapped Businesses Will Have Hard Time Paying Higher Duties

$21,000 for two shipments is not pocket change. Just to maintain the same inventory levels, Vision Furniture will have to pay an additional $150,000-plus in 2019 compared with previous years. And any expansion to our inventory will cost significantly more money up front.

Companies without liquid assets are going to have a hard time coming up with the funds to pay these higher tariff rates. Some companies will have to close their doors or change their business model. Even our business for quality chiavari chairs is uncertain with these new costs.

Companies that supply the event industry are going to have to raise prices to maintain their margins. China can still be a reliable source for products, but these tariffs and subsequent price hikes will be the new normal.

What Do the Industry Insiders Say?

We asked some industry experts on how they think these costs will affect the marketplace and all the moving parts that will have to adjust.

“The extremely rapid implementation of many of these new tariffs has placed a great deal of stress on companies, many of whom were locked into long-term sales contracts with no provisions for additional duties that were not anticipated,” says Robert Stein from Mohawk Global Logistics freight forwarding.

After continued back and forth between the U.S. government and China, many were hoping that an agreement would be reached, and these tariffs would be lowered or removed all together.

Marilyn-Joy Cerny of Sander, Travis & Rosenburg P.A. International Trade/Export Law states, “The imposition of punitive duties on Chinese-origin goods has been fast and furious. There is not much time to react, and the uncertainty of it all has importers reeling. They are affecting companies large and small, so we have seen an increase in inquiries from not only current clients but new ones as well. Many political and industry experts have speculated that these tariffs could be around for a very long time. Decades, in fact.”

Costs Are too High to Absorb. Prices Must Go Up for Consumers.

Earlier in 2019 with the implementation of the 10 percent tariffs, many companies planned to absorb at least some of the additional costs. But now that we have hit the 25 percent mark, that is simply not possible. Costs for companies buying these goods (rental companies, banquet halls, hotels, wedding venues, convention centers) will have to go up, and that means that they will have to charge higher prices to their end users. So, in the next few months or even weeks, the event industry could see higher prices trickling down to those throwing corporate events, weddings and other special events.

Who’s Moving Production? Who’s Paying the Tariffs? Who’s Shuttering?

Vision Furniture has no plans to move our factory out of China. Moving the factory and starting over with all the quality assurance and testing we do on our chairs would cost considerably more than these 25 percent tariffs. We are going to stick it out and hope that our clients will still find our chairs the best option for their business even at the new price levels.

Mark Tempel, general manager of DC Rental in Washington, is being strategic with how he plans to handle expansion moving forward. “The tariffs will affect expansion plans, but expansion will still happen. We plan to stay away from China goods until this has been settled,” he says. “Importation from China is really only for the companies that can handle the entire supply chain and need large amounts of items year after year. It is not worth the cost and lead times if this is not the case.”

What will be the impact on the special events industry?

Only time will tell what the final impact will be. If the tariffs endure and become the new normal, the special events industry will see higher prices from importers. The industry may even see some suppliers who rely heavily on goods from China close their doors because they are not able to pay the tariffs.

Long term, the industry may move away from China to other sources. Small companies who relied on China for cheap goods may be priced out of the market entirely, and there may be a slowdown in small businesses starting small-scale event companies because of the extra costs of doing business. “When you are starting out, a few thousand dollars means a lot. Established companies with solid inventories have the advantage of having locked in their when things were cheaper and there were no tariffs.” says Sonya Feldner, vice president of Vision Furniture.

Trade talks are continuing between the U.S. and China, and we will see what happens in the next few months. But for now, companies are going to see the effects of 25 percent tariffs on their bottom line.

Anthony Tokarchyk is owner and president of Vision Furniture, a manufacturer of wood chiavari chairs and cushions for the special event industry, as well as a regional special event rental company located in Philadelphia.